Amazon

6 Strategic Fixes That Help DTC Brands Succeed on Amazon Without Compromising Control

Why DTC Brands Stall on Amazon (And What You Can Do About It)

Selling DTC through your website gives you control. Selling on Amazon introduces chaos, unless you’re ready for it.

Established brands often enter the Amazon channel late. Sometimes it’s fear of brand erosion. Sometimes it’s the lack of internal bandwidth. Sometimes it’s just Amazon horror stories. But here’s the real problem: waiting too long or launching without a strategy costs you more than control. It costs you market share.

And here’s the truth many DTC leaders quietly admit: even after they get on Amazon, sales plateau, brand equity slips, and they can’t figure out why.

Let’s walk through six strategic fixes that have helped DTC brands work with Prime Retail Solution scale as managed 3P sellers, without sacrificing pricing control, brand identity, or channel profitability.

1. Fix the Channel Conflict Before It Starts

Your brand team might be obsessed with the DTC funnel. But if you leave Amazon to chance, unauthorized resellers and distributors will do the job for you poorly.

Here’s what happens when you wait:

- Retail partners list your products without proper copy, images, or pricing enforcement

- Inconsistent ASINs show up with outdated branding or missing variations

- Your team ends up cleaning a mess they didn’t make

Strategic fix: Hire an exclusive 3P partner. When you’re the only authorized seller through a managed 3P model, you can:

- Enforce MAP (Minimum Advertised Price) effectively

- Control listings, A+ content, and storefront messaging

- Track unauthorized listings and remove them

This works especially well when backed by Brand Registry enforcement. PRS uses proactive monitoring and internal flagging tools to keep grey-market sellers out of your ecosystem.

Brand Registry’s ‘Report a Violation’ tool helps sellers report unauthorized sellers directly to Amazon.

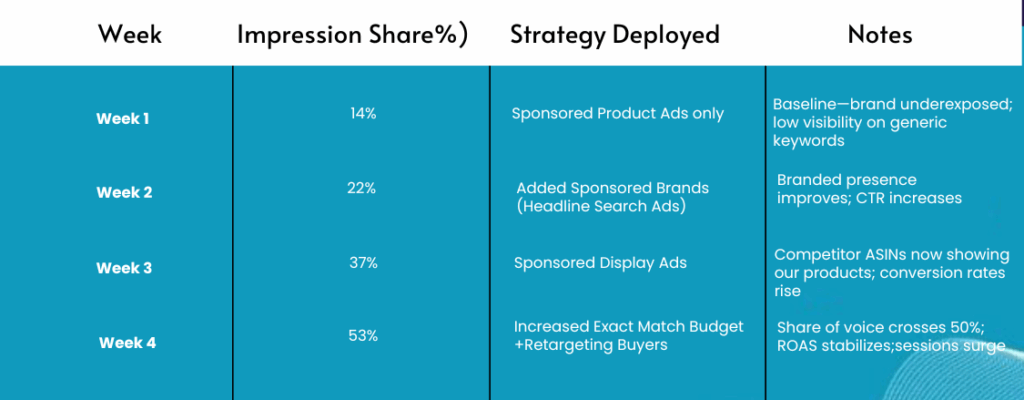

2. Use the Amazon Brand Share Impression Report to Drive Retail Decisions

Too many DTC brands track Amazon like a spreadsheet. Units sold, ad spend, TACoS. But what about your market presence?

The Amazon Brand Share Impression Report gives you a different view: How often shoppers saw your brand vs competitors.

Why it matters:

- Visibility leads behavior: if they don’t see you, they don’t click you

- Low brand share = high spend for low return

- Growth gets expensive when your brand isn’t even showing up

How PRS uses it:

- Identify ASINs with strong conversion but low impression share

- Allocate ad budget toward brand-defending campaigns

- Spot rising competitors early and adjust catalog accordingly

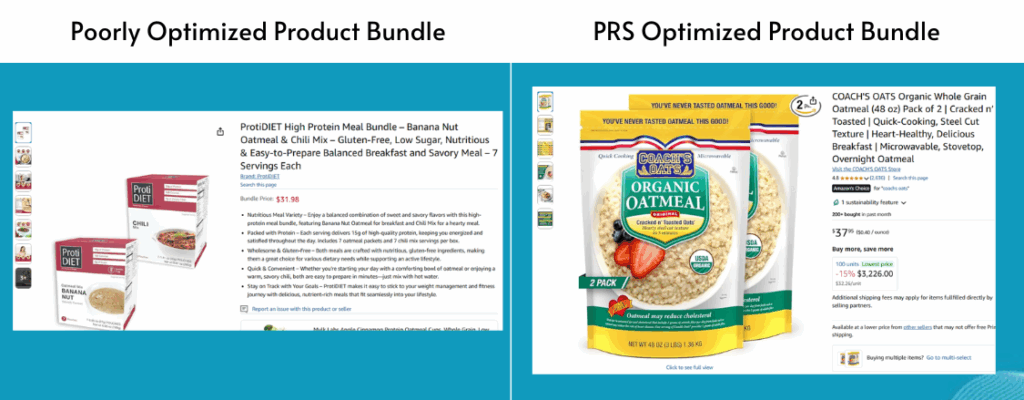

3. Bundle Intelligently, Not Randomly

DTC bundles work on your site because you guide the user journey. On Amazon, shoppers don’t read instructions, they type what they need.

Why most bundles fail on Amazon:

- They’re based on brand logic, not keyword logic

- They don’t trigger high-volume terms

- They don’t compete on price-per-unit

Strategic fix: Reverse-engineer bundle creation based on:

- Amazon search volume data (from tools like Helium 10 or Amazon Brand Analytics)

- Price gaps vs 1-pack offers

- Common use-cases (e.g. “starter kit”, “2-pack travel”, “day/night routine”)

At PRS, we test bundles that align with real demand. One brand saw a 3.2x ROAS boost by splitting their 4oz lotion into two 2oz TSA-approved bundles under a new ASIN.

Checklist for bundle viability:

- Does it target a new keyword cluster?

- Is there a price advantage over individual units?

- Does it match Amazon buying behavior?

4. Stop Thinking in DTC Launch Cycles

Amazon doesn’t care about your product calendar. The algorithm cares about momentum, not marketing.

DTC mindset: Big launch, big push, post-launch fade.

Amazon success formula: Consistent sessions + consistent conversions = ranking.

Here’s how we fix that at PRS:

- Use drip-launch PPC strategy (top-of-search ads on 2-3 exact terms only)

- Delay Vine and deals until you have 15+ reviews

- Encourage external traffic via attribution links (influencer or email traffic)

Brands that treat Amazon like a marathon, not a sprint, gain organic rank faster. Momentum compounds. You earn the algorithm’s trust by behaving predictably.

5. Clean Up Variation Abuse (or Lack of It)

Your team might assume Amazon knows how to group or split products. It doesn’t.

What goes wrong:

- Variations are split incorrectly, so reviews don’t aggregate

- Child ASINs get buried because they don’t benefit from parent ranking

- Or worse, the wrong ASIN becomes the parent

Strategic fix: Rebuild your variation structure based on:

- Shopper use cases (e.g., “flavor”, “color”, “size”)

- Search term indexing potential

- Review strategy (merge when reviews help, split when positioning varies)

PRS has rebuilt variation structures for several DTC brands where child ASINs were outranking parents. After fixing, overall session and conversion lift ranged from 25% to 70%.

6. Your A+ Content Probably Looks Great but Performs Poorly

You spent weeks designing A+ content that aligns with your website. Problem is, Amazon shoppers don’t scroll like your DTC visitors do.

Common mistakes we see:

- Image-heavy modules with zero crawlable text

- Branded imagery with no context or benefit callouts

- Reused site assets that don’t match Amazon formatting

Fix it with a split-tested structure:

- Above the fold: 3 benefits, not features

- Middle: Product comparison chart vs competitors

- Bottom: Brand story, sustainability or social proof

PRS runs frequent A/B tests using Manage Your Experiments. The changes aren’t always flashy. But a 5% lift in conversion from A+ content is real money when you’re doing volume.

Final Take

Amazon isn’t a distraction. It’s your retail scoreboard.

And if you’re a DTC brand still treating Amazon like a channel you “need to get around to,” you’re losing control. The longer you wait, the more you pay in clean-up, missed sales, and lost mindshare.

These six strategic fixes aren’t just ideas. They’re operational levers we pull every day as an Amazon exclusive selling partner.

So if you’re ready to control your brand’s Amazon channel the way you run your DTC site, you don’t need more time. You need the right partner.

Want a walkthrough of how your brand compares? Ask PRS for a free channel audit including your Amazon Brand Share Impression Report, competitive gap review, and exclusive 3P strategy blueprint.

Share